The S&P 500 hit a low of 666 on March 6, 2009 and was up 213%, excluding dividends, through November 4, 2016. You know we’re big fans of dividends, which actually account for more than half the total returns in this index over the long-term. Since then, the S&P 500 is up another 4.6%, and closed just 0.5% from a new all-time high Friday November 25 2016.

Can you believe there are people who still have not put their money to work since 2009! What are they waiting for? Eight more years? Inflation is the enemy, not our elected officials.

Get ready for more growth. We saw the S&P 500 hit an all-time high a few days towards the end of last month as the bull market in US equities continues, and we expect equity values to boom in the years ahead.

This is hard for some to believe, especially those who think the bull market that started back in 2009 is a “sugar high.” After all, the Federal Reserve has ended Quantitative Easing, lifted rates once last December and, according to futures markets, has 100% odds of lifting rates again this week.

But Quantitative Easing and zero percent interest rates were never the reason stocks rose. It’s true that low interest rates can push stock prices higher. Future earnings are worth more today when discounted with a lower interest rate than they are with a higher interest rate. Lower interest rates can justify higher price-to-earnings ratios.

But, since 2009, the capitalized profits model we assess, which uses economy-wide corporate profits and the 10-year Treasury yield to value stocks, consistently said US equities were undervalued. This was even true when we used a higher discount rate. These days we use a 3.5% 10-year Treasury yield (higher than the current 2.3%) and the model still says stocks are undervalued by almost 25%.

But that’s just the beginning. Even though the Federal Reserve is on the verge of lifting interest rates, monetary policy is about to get much more accommodative. Click on CNBC one of these mornings and see if they talk about the spread between our 10-year Treasury yield and the European 10-year Bund. This is very telling as it alludes to the notion of finally talking about fiscal policy in our country and veering away from monetary policy that Europe seems to want to keep trying over and over. Too bad Congress isn’t required to balance their budget like Golf Professionals are required to do.

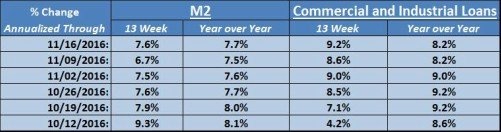

Quantitative Easing never had much impact on the economy because with one hand government was shoveling money into the economy, but with the other hand was hammering banks with regulations, higher capital requirements, and fines. The result was that, in spite of QE, the growth rate of the M2 measure of money never accelerated. This is why inflation never accelerated and we can say QE was not the reason stocks rose.

Source: St. Louis Federal Reserve Database

With the election of Donald Trump as the 45th president of the United States, either new regulation will be avoided or existing regulation will be rolled-back. Proponents of free markets suggest that this means excess reserves should start to boost money supply growth and the economy. Even before the election, stock market analysts were already predicting that earnings growth for the S&P 500 in the next year would accelerate from the 3.1% year-to-year decline in earnings seen in Q2 2016, to a 14.4% gain for the same quarter in 2017. With money growth accelerating, economic growth and earnings growth are likely to grow even more than the consensus expects.

This doesn’t mean we need to act like Randy Quaid in “Vegas Vacation” and put all our children’s college money on black at the roulette table. We do believe the sooner you invest money that is sitting on the sidelines without a purpose (i.e. emergency fund, property taxes, etc.) the better. Large-Cap Value, blue-chip, American based companies that have been around for decades that have a track record of paying a stable and growing dividend is a good start.

Imagine what happens when policies get better? You and I make a little more money and keep a little more. Other people earn more and the companies they work for have more to spend on golf outings, lessons, memberships, etc. Do yourself a favor this December and set aside one more percent toward your own retirement. Set it on auto pilot each paycheck so that you don’t even miss it.

Let us know a little more about your situation and we’ll do our best to get you going in the right direction with regard to all of your financial matters. It’s never too early nor too late to start investing for your future.

Blake Parrish

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”