“You don’t know what pressure is until you play for five bucks when you only have two bucks in your pocket” – LeeTrevino

Have you ever heard that the markets are a game? That the system is rigged? Don’t take a gamble with your hard-earned money? Why risk everything? Well, if you feel any of these emotions, I suggest considering value investing rather than trading.

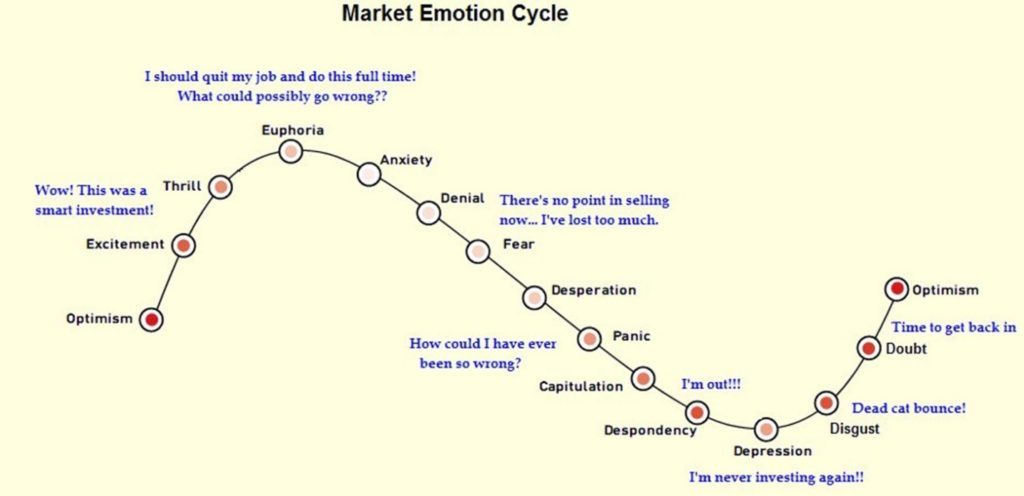

Anxious stock investors were reassured to see volatility subside in the immediate aftermath of the U.S. presidential election. But in a bull market that’s already more than seven years old, worries about volatility can quickly resurface. Volatility is widely feared as a major investment risk, and when it spikes, some investors can be expected to panic. Take a look at the emotional cycle below to see how human nature feeds on market cycles.

Disciplined value investors generally don’t share in this reaction because they don’t equate volatility with risk. Some value investors believe that the real risk of investing is not short-term variations in share prices – volatility – but permanent impairment of capital and staying on the sidelines too long if not indefinitely.

To help mitigate this serious risk, value investors buy stocks that are trading at what they consider a discount to their intrinsic value. (The difference between the purchase price and the intrinsic value is known as a “margin of safety”) When volatility drives other investors out of the market, prices of attractive stocks may fall below their intrinsic value. For value investors, these windows of distress may create buying opportunities. But to take advantage, investors need to have cash (or money market cash) on hand. When share prices climb steeply and stocks in the portfolio approach their intrinsic value, some positions will be sold. The question is what to do with the proceeds. In a very frothy market, there may be few stocks selling at prices that offer a margin of safety.

Some value managers believe it’s more important to stay true to their convictions than to stay fully invested. When discounted stocks are scarce, these managers hold their residual cash and wait patiently for volatility to return and what they believe are better prices to reappear. Used in this way, cash can serve as a bridge between buying low in volatile markets and selling high in buoyant ones. This is one of the many reasons we believe so strongly in owning cash producing assets as it allows cash to constantly build for times when value appears to be most obvious. The “no-brainer” opportunity if you will.

As market valuations rose in the spring and summer of 2007, some value managers could not find quality businesses that were trading at what they considered appropriate discounts to intrinsic value. Cash built up to as much as a fifth of their portfolios. When the global financial crisis struck, these managers were able to deploy their cash into windows of distress without having to sell shares that, at the time, they considered undervalued. By early 2009, as the financial crisis unlocked value opportunities, the proportion of cash in their portfolios fell to the mid-single digits. Is your advisor or your portfolio implementing a plan like this? If not, it never hurts to look into it and find out if you should be.

This kind of rising and falling cash position should not be confused with market timing, which is a strategy based on entering and leaving a market in order to take advantage of anticipated future prices. This false belief of market timing leads people away from discipline as they gradually sit on way too much cash until the next crash or pullback that always comes and goes without telling them ahead of time. They typically miss it every time and continue sitting in cash. These traders are usually the same people who never return the market because they are trying to time a good opportunity that never comes in their mind. Meanwhile, time is wasted and inflation eats away at their money. Disciplined value managers tend to view the future as unknowable.

Variations in their cash holdings are a byproduct of a disciplined, bottom-up investment process rather than an effort to capitalize on predictions of asset prices. We always generalize and say, for every speculation of the next “Google or Facebook there are a thousand losers”. Value investing looks at the fundamentals of each company, management’s ability to earn money for shareholders, and financial statements rather than the headline stories of the day.

Disciplined value investors generally have a through-the-cycle perspective. They know that if they have an allocation to cash, they are likely to lag in runaway bull markets. But they also know their potential outperformance in volatile markets may more than make up for this shortfall. As share prices come under pressure, a cash reserve helps to cushion a portfolio against the full effects of the downturn and, as we’ve seen, the cash can be put to use as good stocks become available at a discount. Please call us if you would like to know more about your current plan.

Blake Parrish

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”