In golf, a bad shot may ruin your otherwise perfect plans to make birdie. In life, an unexpected illness can throw off our work and personal lives. You are responsible for your own retirement. You are responsible for your own pension plan. You have to be concerned. You have to be focused. You have to have a plan.

We all practice and fine-tune our golf games. The good intentions to practice and work hard is not enough, the practice must have a purpose. This holds true for retirement as well. We can’t just work for a living, we have to have a plan which involves managing our debt and investing wisely with a purpose.

There are issues that will get in our way from time to time and we have to be aware of them so that we continue to make smart decisions with our money and improve on our daily habits with our money. Following are the four main obstacles we’ve seen with our clients and how to solve them.

The first obstacle is simply misunderstanding retirement. Goals. Dreams. What does it mean to retire anyway? Too many people in their twenties, thirties, forties, and even fifties think that retirement is way off in the future and irrelevant to their lives today. Others may think retirement is an age, something that magically happens on their sixty-fifth birthday. Both assumptions are off base. Retirement is much, much bigger than any of that, and your retirement depends 100 percent on what you are doing today. Habits, throughout your lifetime, with your money are more important than market returns on your investments.

The second obstacle is the dependence on social security and whether we’ll be receiving pennies on the dollar. Something like 35% of American retirees over the age of sixty-five relies almost entirely on Social Security payments today. Wow. The average benefit is only $1,195 a month which won’t buy too many rounds of golf. We try to tell people not to count on SS and factor in 75% of whatever they are saying that your payment will be about …..a month. Do you really want to place your financial well-being in the hands of a government that has proven over and over and over again that it can’t do simple math? Our advice is to think of SS as a fringe benefit.

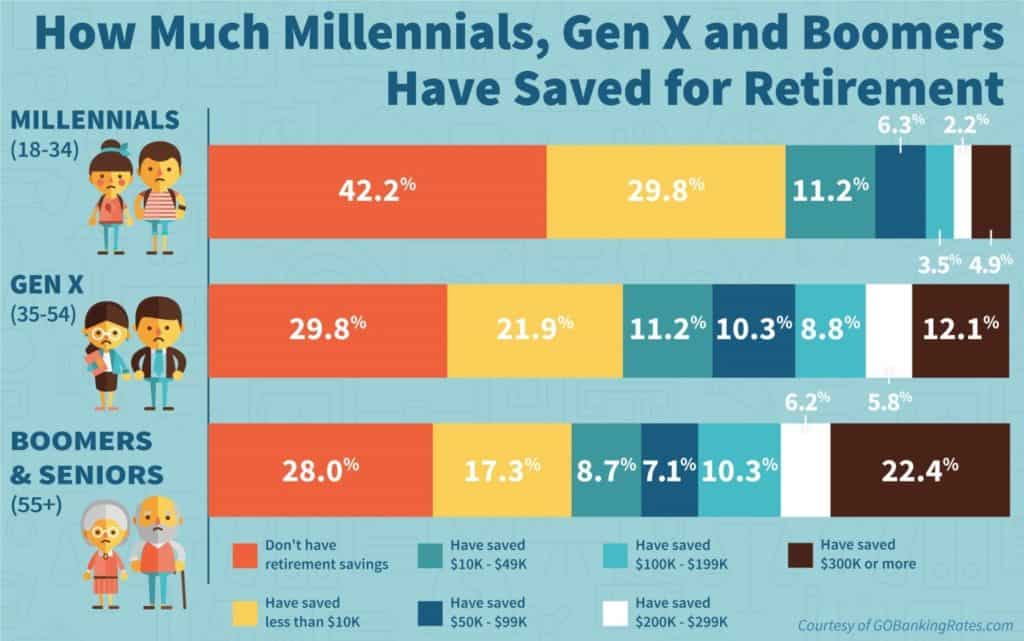

The third big obstacle is our general attitude about retirement, and it stinks. Numerous studies show that half of 401(k) participants have less than $10,000 saved for retirement and those are the people actually doing something. One in five, or 20%, have more than $100k but that’s only okay if you’re under 40 years of age. The time value of money works when you have time on your side.

If your company is matching, you should be taking at least the match unless you are currently paying off massive debt. In that case, you better stay laser focused on paying off debt in a short period of time and then take advantage of the company match on your 401(k) when you are debt free, other than the house mortgage.

One last obstacle I’ll mention here is a big one. It’s the one that keeps retirees dependent on Social Security. It’s simply not having a plan. In all the years I’ve been working in finance, it’s the lack of a plan that gets people in trouble. We all make mistakes, loan money to family or friends that we’ll never see, invest in poor investments, buy things that have no investment value, etc. But, doing retirement right can propel any of us on the path toward greater financial wealth and it has nothing to do with intentions. It has everything to do with staying on the right path- with having and maintaining a plan.

Taking personal responsibility for your own retirement is the first step toward success! Retirement is not an end, an age, something to be afraid of, the day we turn broke, etc. Retirement is a chapter, phase to embrace, or new beginning. Some people might say that retirement is not just the rest of your story, but the best of your story. The writer for Bob Hope used to say “retirement means no pressure, no stress, and no heartache – unless you play golf.” Let someone at B P Financial help with your plan so that you know you’ve exhausted all relevant possibilities to set yourself up for SUCCESS.

Blake Parrish, CFP®

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”