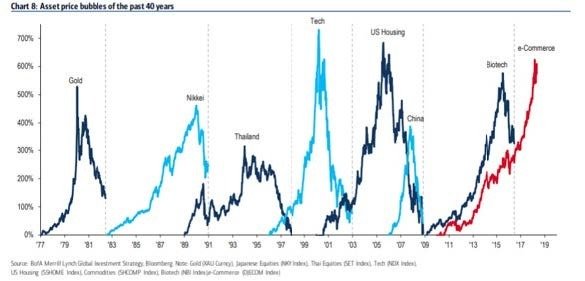

About every seven years a consensus forms around the fastest growing sector of the stock market, or the fastest growing country, or the fastest growing industry. Do you remember how excited everyone was about investing in China? Over fifty major global companies have been relocating manufacturing outside of China the last two years and where did those 500 million new middle-class citizens go which many of us knew were going to make companies rich? History shows that themes of popularity are an invitation for poor forward returns. Simultaneously to the over-pricing of well-known facts, is the underpricing of the futures of meritorious companies which are suffering temporary forms of tribulation.

1. In 1999, everyone thought the internet was supposed to change our lives and reduce the use of paper.

My daughter uses a chrome book for school but I swear she also uses more paper than we ever used. Will artificial intelligence and data analytics be any different?

The chart below shows the biggest parabolic moves in price in the past 45 years. We believe investors have expressed their e3xcitement about AI and data analytics first through the most successful e-Commerce companies.

2. Everyone thinks inflation is dead and that interest rates are permanently going to stay near historic lows.

However, long-time bond market watcher and veteran financial writer, James Grant, thinks otherwise. Interest rates tend to change course only once or twice a generation. In 1981, investors could look back on 35 years of generally rising rates. In 2016, a different generation of investors could look back on 35 years of generally falling rates. In bonds, you can profitably spend a whole career not changing your mind.

Humans eat, sleep, and extrapolate, says James Grant. What we think we can foresee is often nothing more than what we have recently seen. More of the same…is the sensible default prediction in politics, baseball, golf, and interest rates alike. In rates, it actually tends to work. (Source: Barron’s-“low interest rates forever don’t count on it”).

3. Everyone thinks they know all you need to do is invest in the consistent growers.

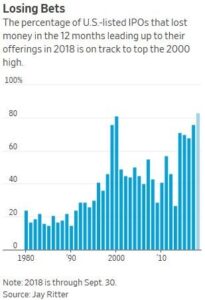

A rash of explosive initial public offerings of common stock has punctuated every historical growth stock binge. Fortunately, we don’t have to wonder if we have entered this crazy stage. Every week Wall Street brings a new series of exciting growth stocks public and many of them are tied to the most exciting and well-known themes. (AI, data analytics, healthy eating, delivery via technology, etc.) Historically, you can anticipate the bloodshed within a few years when the over-supply of new growth stocks overwhelms existing supply and crushes prices for growth stocks. We are in the crazy stage in growth stocks.

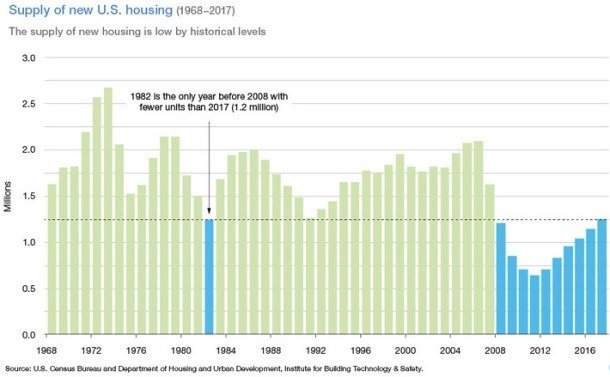

4. Everyone thinks millennials will attempt to keep their adolescence and continue living in their parents’ homes.

While the deep recession and more years devoted to four-year college degrees have pushed maturity back five-plus years in the U.S., our research shows that 25-year old women want very similar things to women in prior generations. Turning Point USA has internal surveys that show generation Z as a very fiscally conservative generation willing to work hard and own investments for the long term. Most of them ultimately want a spouse, and a home they can call their own. These are college educated men and women and the best educated group of people we’ve ever had. As the chart below shows, the U.S. might be the most under-built on single family residences as any time since 1960.

In conclusion, we are very comfortable stacking long-term probabilities in our favor by being very contrary to today’s popular and unpopular knowledge. We are getting very favorable prices on te unknown futures of our value stocks (all dividend payers) and are avoiding getting caught in over-priced and well-known trends with load of momentum attached. We think we have a handle on the price of knowledge. We believe our clients will get rewarded over the next five to ten years.

Blake Parrish, CFP®

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”