“Always count your blessings. Be thankful you are able to be out on a beautiful course. Most people in the world don’t have that opportunity” – Fred Couples

Remember fears about adjustable-rate mortgage re-sets, or the looming wave of foreclosures that would lead to a double-dip recession? What about Y2k at the turn of the century? Remember the threat of widespread defaults on municipal debt? Many of these stories flood our news channels and social media platforms and pretty soon people start to believe that they need to be in defense mode 24/7.

Every investor worries from time to time. It is their hard earned money that is invested. But, if we all know that the markets cannot be timed perfectly before going up, why in the world do some investors think they can time it perfectly when the markets go down?

Let’s take a look at the glass from a point of reason.

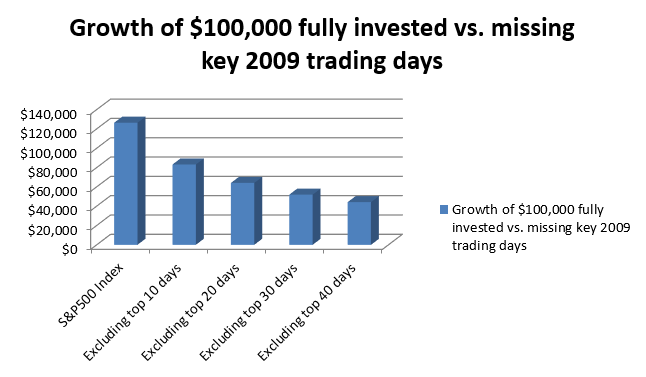

The year 2009 was a very volatile year for investing, so many investors were tempted to get out of the market – but investors withdrew at their peril. For example, if you had invested $100,000 on January 1, 2009 but missed the top 10 trading days, you would have had $43,000 less by the end of the year than if you’d stayed invested the whole time. There is countless other research that shows similar results. One of my favorite studies is by Michigan Professor H. Nejat Seyhun who analyzed 7,802 trading days for the 31 years from 1963 to 1993. He concluded that just 90 days generated 95% of all the years’ market gains – an average of just three days per year. Good luck picking those three days each year for thirty years. The expected returns of markets are both positive and essentially constant. Therefore, investors who are out of the market for any period of time can expect to lose money relative to a simple low-cost and tax-efficient buy-and-hold strategy.

Buy-and-hold is still your best bet…

Additional data also suggests that buying-and-holding is your best bet. The folks at J.P. Morgan Asset Management, utilizing data from Lipper, examined the returns of the S&P 500 between Dec. 31, 1993, and Dec. 31, 2013, and made an intriguing discovery.

Despite undergoing two very steep corrections of 49% and 57% on the S&P 500, investors who bought and held those roughly 5,000 trading days earned more than a 480% return. That’s a figure that would handily outpace inflation over the long run, leading to real wealth creation. But here’s where things get interesting: If you missed out on just the 10 best days over this approximately 5,000-day trading period, your returns fell from 483% to just 191%. Missing the 30 best days would cause your return to sink to less than 20%, or lower than 1% annualized.

The data suggests pretty clearly that staying invested over the long term is your best way to prosper, and that trying to time the market can cause you to miss out on some bad weeks, but also some very strong weeks, too. Missing even a handful of the market’s strongest days could be the difference between retiring early, or perhaps many years later.

Successful planning can help propel net worth but even more important is to simply start saving and investing today. Twenty dollars per month gets you in the game and after a few months you’ll have enough to buy a large index fund that mirrors the S&P500. When you get a little more money invested you start to see how easy it is and how little your daily life was affected by saving money for your future. And, by putting it on “auto pilot” so that the money moves automatically from your paycheck or bank account directly into your investment account you won’t be tempted to break the pattern. Remember, aggressive savings should outpace any attempt to try for big gains through market performance. You’ll need to use this money in the future to pay for such things as a home down payment, college tuition, retirement, etc. and so it’s on you to save the money for these things. It is your efforts to save often and early that will build wealth rather than relying on outside forces to create wealth for you. When a glass is half empty, it should be because you’re saving a lot of what you earn today so that you can live with a glass half full in the future.

Blake Parrish, CFP®

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”