“Forget your opponents; always play against par” -Sam Snead

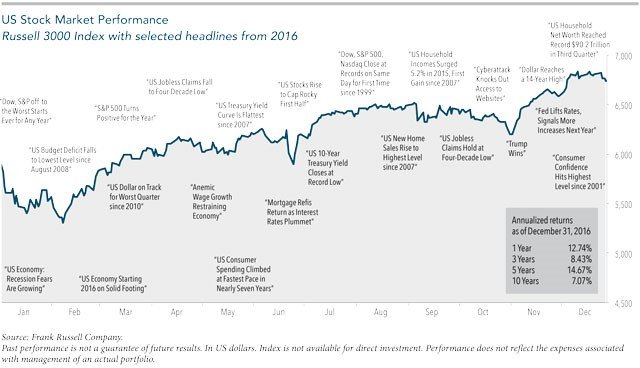

Remember these headlines from 2016?

The year 2016 started with the WORST START EVER, for any year, for the DOW and S&P 500. I remember it like it was yesterday as we fielded calls from nervous clients. Yet, if you were investedin the broad markets for the entire year, we finished the year in the positive. Why is it that the one place (US stock markets) we can grow our wealth over time is the one place that is viewed first as a sham or fools game? I would argue that there are other risks to pay attention to. How far your dollar goes is important and will continue to be more important than politics and whether the stock market is up or down.

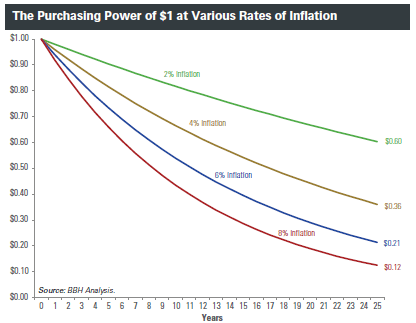

Why worry about how much you can purchase when we have low inflation? You and I should care because a little inflation goes a long way. We are all familiar with the power of compound interest – how a small amount of money can compound into a great fortune over time, even at paltry rates of return. Save early and save often is what we always tell our young workers! Well……inflation can cause a great fortune to dwindle into little purchasing power over time in the same manner just by substituting the inflation rate for a rate of return.

Consider the following graph, which illustrates the purchasing power of a dollar in various inflation scenarios. Even at a modest inflation rate of 2% (pretty much where we are today), the real value of a dollar drops by 40% over a 25-year period.

This 25 year period is not a long time even if you’re newly retired as people are living longer during retirement years. To make matters worse, we have massive unfunded liability problems with social security obligations, pension contract obligations, and Medicare not to mention $20 trillion in debt and deficits as far as the eye can see. Does anyone really believe inflation will stay low the next 25 to 50 years? Higher rates of inflation pose a more obvious risk to how much your dollar can buy, but the lesson of this graph is that the steady drain of even modest inflation greatly impairs purchasing power over time.

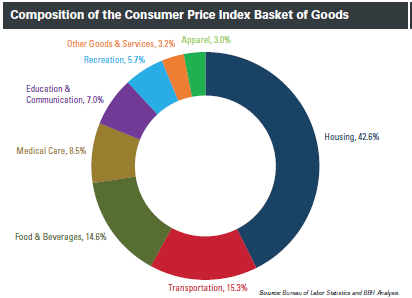

Not all inflation is created equal. The Consumer Price Index (CPI) measures headline inflation which has been at or below 2% the past five years. It is based on a basket of goods and services that is meant to represent the purchasing patterns of an average American consumer. The basket is updated from time to time to account for product developments and shifting consumption trends, but no single snapshot of spending habits can adequately capture the range of American consumption.

Not all inflation is created equal. The Consumer Price Index (CPI) measures headline inflation which has been at or below 2% the past five years. It is based on a basket of goods and services that is meant to represent the purchasing patterns of an average American consumer. The basket is updated from time to time to account for product developments and shifting consumption trends, but no single snapshot of spending habits can adequately capture the range of American consumption.

Housing, transportation and food account for three-quarters of household spending for the average American. Housing (which includes rent, maintenance and utilities) may not be as big of a spending area for families with substantial wealth. The inflation calculation adjusts for home ownership by calculating a “rent equivalent” for an owned home and then tracking the change in comparable rents. This makes sense when using statistics, buy I would argue homes tend to be more of an asset than a big spending category. Homeowners can downsize, use home equity lines of credit, reverse mortgage, collect rent, etc. Renters do not have these options when running into tough financial times. Transportation (includes gas, maintenance, public transport) similarly might not take up 15% of your own budget. On the other hand, education is a big deal with our clients and Oregon seems to win out every year for highest cost of daycare in the nation. I could have had a nice cottage at the coast for the money I spent on my kids in their early years. Worth every penny, though.

How Can I Protect Myself Against Inflation (“Par”)?

Try to own investments that offer you some kind of cash flow. Rental properties and dividend paying stocks are among the best.

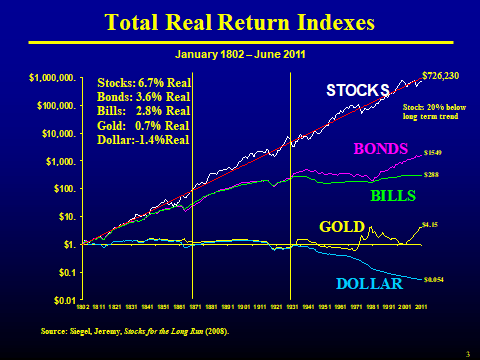

Some investments provide better protection against inflation than others, although the American Stock Markets have a clear track record of predictability over long periods of time. Remember that 200 year chart of the S&P 500 Total Return Index? The red line on the chart below is the only predictable line I can see and it is by far the best way to beat “Par” which is another term for “Inflation”.

People who are about ready to retire almost always say to us, “I don’t want to invest right now as the markets are at all- time highs and I plan to retire soon”. My response is always the same, “If you don’t invest in an intelligent way that gets the cash flow coming in, you are destined to take a pay cut each and every year for the rest of your life.”

Inflation is dormant, but it is not dead. Energy prices are extremely cheap from electricity to the natural gas we use to heat our homes to transportation costs. Inflation should nevertheless be a concern of any family seeking to protect, preserve and grow its wealth for the benefit of future generations. It is precisely the fact that inflation poses a low apparent risk that makes it most dangerous. And, as we have seen, it does not take much inflation to eat away at the value of a dollar.

The solution to the challenge takes the form of careful consideration in how your money and investments are working for you. Let us know if you would like to get a better understanding of your money, and one of our associates will schedule a time to review where you are and where you need to be.

Blake Parrish

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”