It’s enticing – you’ve built up a nice balance in your health savings account (HSA). Should you tap it for non-medical expenses? No!

The thing is, you contribute to an HSA—tied to a high-deductible health insurance plan—on a pre-tax basis. You don’t EVER pay income tax on the money you contribute and withdraw, including any earnings which grow tax-free—so long as you spend it on out-of-pocket medical expenses. That’s a no-brainer in the world of golf. If you take the money out and use it for anything non-medical, you get hit with federal and state income taxes. If you’re under 65, you’re dinged an additional 20% penalty. You report taxable distributions (and any penalty) on your tax return.

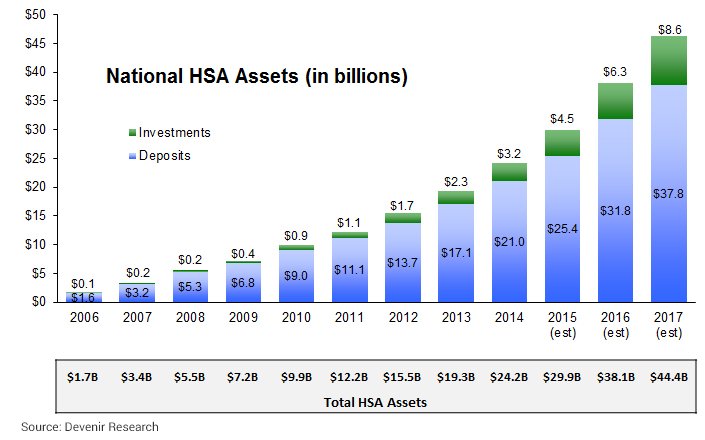

So what should you do with an old health savings account? Should you tap or drain it, keep it invested, or roll it into a new HSA? After all, it’s yours to keep when you switch jobs. A 29-year-old PGA member was savvy enough to invest his HSA dollars—that’s how he grew an account balance in just one year to $5,000. For 2016, you can contribute $3,350 for individual coverage or $6,750 for family coverage (plus $1,000 annual catch-up contributions are allowed once you’re age 55). Once your account reaches a certain balance—typically $2,000—you can invest the money in mutual funds or other investments, with the aim of growing a tax-free, rainy day healthcare expense kitty. The number of HSA accounts rose to 14.5 million, up 23% in just a year, and investments are making up a bigger portion of total assets, which are approaching $30 billion, according to Devenir’s mid-year 2015 report.

Keeping a health savings account open until retirement might seem like forever to a Millennial—but it’s a smart long-term strategy (some account holders have amassed $150,000 health savings accounts). In retirement, you can easily drain your HSA to cover Medicare premiums, long-term care insurance premiums, even remodeling your house to make it accessible if medically necessary. Once you’re 65, you can spend the money on non-medical needs, and the 20% penalty no longer applies, but you still owe income taxes on it; so it still makes more sense to spend it down on medical needs.

You say you have your dream job in the golf business that comes with a superb health plan? Maybe so. but even with the most generous PPO health insurance plan, out-of-pocket expenses, like deductibles, will still add up. Deductibles are going up–$1,000 a year is common for an individual deductible. Co-pays (what you pay each doctor’s visit) and co-insurance (what percent you pay for each visit after you’ve reached the deductible) are also on the rise. If you get married and have kids, you’ll be able to use your old HSA for expenses for your spouse and kids. If you change jobs again, you can tap an HSA balance to pay COBRA premiums if you decide to continue health coverage through a former employer.

More information on HSAs can be found in IRS Publication 969. Or call Blake and his team direct to learn more about how to get your fiscal matters in order.

Blake Parrish

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”