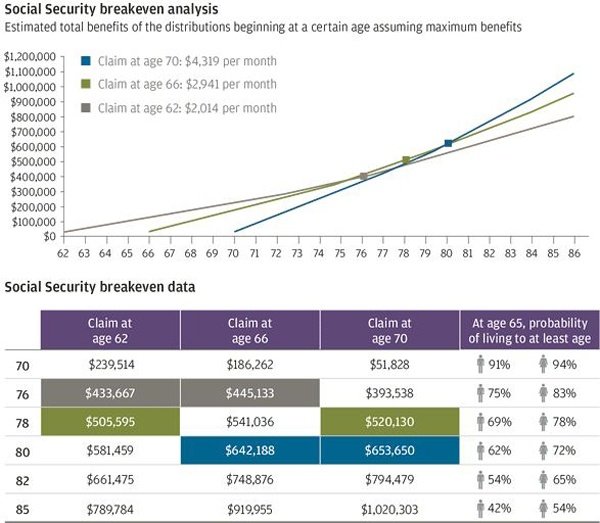

In many cases, it can still make sense to delay filing for your social security retirement benefits. The longer you wait, the greater your monthly benefit becomes, which can also mean receiving more money over your lifetime. Keep in mind, you need ten years of work for full benefits and they use your top 40 quarters, or three month periods, to calculate it for you. As you can see below, it doesn’t take long for a person who waited until age 70 to claim their benefit to “break even” compared with taking it at the age of 62. If you have a family history of longevity and can afford to push off taking social security until 70, it may be the best way to go over your lifetime. However, life expectancies are not guaranteed – as the priest found out in the movie “Caddie Shack”.

The end of the “File and Suspend” strategy is April 29, 2016

It goes something like this. To utilize the file and suspend strategy, you apply for retirement benefits at the full retirement age (age 66 if you were born within 1943-1954), allowing your spouse to collect their benefits based on your earnings record. Then, you immediately suspend your own benefits and delay claiming them until they are worth more at an older age. Your benefits will increase by an additional 8% for each year you delay collecting beyond your normal retirement age, up until you turn age 70. And, your spouse gets the higher of hers or the spousal while you wait.

Sounds reasonable, right? Well, hold the phone…..Congress has already passed an agreement that will close the window on this social security retirement benefit strategy that we’ve used for years when it best suited the client. According to the new rule, once you suspend your benefit it will suspend the spousal benefit as well.

The end of the “Restricted Spousal Benefit” strategy is April 29, 2016

The second strategy is the restricted application for spousal benefits. Similar to the file and suspend approach, it allowed a person to file a restricted application for just spousal benefits, while allowing his or her own future retirement benefit to grow. Under the new rules, an individual cannot file for just spousal benefits – he or she will be required to file and claim for all eligible benefits.

Talk to a professional about your social security retirement plans. If you are unsure about when to file for your Social Security Retirement benefits, and want to bounce some ideas off one of our advisors, you can feel welcome to give us a call. Often times the decision for how to time your social security benefits depends on your other sources of retirement income, which we can help bring clarity to your situation. We always recommend doing your own research at the source:

Blake Parrish

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com

Certified Financial Planner Boardof Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”