“Golf is a good walk spoiled” -Mark Twain

The economic recovery in the U.S. turned six years old on June 30, 2015. According to the Bureau of Economic Analysis GDP data since March 9, 2009 our economy has been in bull mode. The S&P500 index has returned a whopping 248.3% since.

Despite things getting better in the U.S., it still seems like enthusiasm is somewhat dampened and that more attention is given to the potential fallout from events like the Greek debt crisis and/or the sudden plunge in Chinese equities, in my opinion. In other words, the negative still trumps the positive. Consider that for a thousand years – China was a third world country. In the last thirty years they decided to borrow technology from first world countries (United States) and leap frog into being a high tech powerhouse. This one time infusion only works for a while in a high speed world where other countries keep on developing through free markets and democracy.

Some in the media even went so far as to speculate over whether the events in Greece and China were enough to throw the U.S. into recession. Such thinking is growing more commonplace these days due to globalization. The Chinese stock market is still up 75% higher than a year ago, even after the one month decline in July of roughly 28%. Let’s look at it over a longer period of time. And, compared to our +200 percent gain over the past six years, the Chinese stock market is up a little over 8% (1.4% per year !) This six year trend is not even close to a bubble. I think they only grow 4-5% GDP.

I remember when Japan was the second largest economy in the world during the 1990’s and falling hard while our economy kept growing to new all-time highs. The government got lucky in picking winners and losers, but eventually came to an end. They couldn’t transition toward making new things.

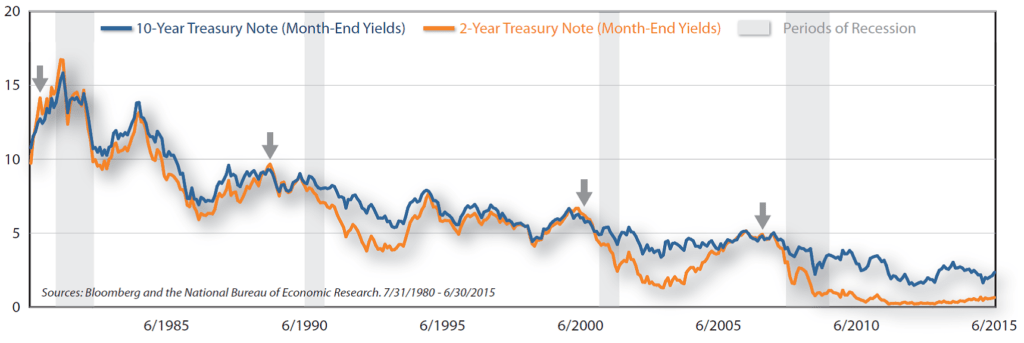

Simply put, if you are worried about the U.S. sliding into recession because of a global meltdown from China’s struggles, and would like to follow a pretty dependable barometer, then monitor the spread between the yields on the 2-and 10- Year Treasury Notes (T-Note).

U.S. monetary policy tends to have a significant influence over U.S. economic cycles. When the Federal Reserve tightens monetary policy, other parts of the yield curve tend to react over time. We’ve been near zero for seven years and a long ways from tightening. But the Fed will eventually induce tight money policy. As indicated in the chart, recessions have tended to occur when the yield on the 2-Year T-Note exceeds the yield on the 10-Year T-Note, which was far from the case at the close of June 2015 (recessions are the highlighted vertical gray lines).

If golf is a good walk spoiled, I’d say the same holds true for long-term investing. You must be an aggressive saver and live within your means. Discipline is a key characteristic to learn. As save money, then invest in the ownership of things, due diligence also becomes important. If you’re ready to surround yourself with a trusted team of competent advisers who perform well for you, the investor, our door is open.

Blake Parrish

Senior VP, Portfolio Manager

Phone: (503) 619-7237

E-mail: blake@bpfinancialassoc.com